Retailers are paying more attention to emergent Generation Z, recognizing the burgeoning opportunity to serve the consumer segment is a lot more than kid stuff.

Retailers from the largest chains to the independent store owners took a big step in engaging Gen Zers this past holiday season as the 18- to 24-year-old bracket was considering how they were going to finance their shopping lists.

After a period of working out how to approach the market with a limited number of stores on the West Coast, China-based retailer Miniso has launched a rollout across the United States. Miniso has opened about 100 locations so far and developing its “10 ‘N Under store format for its American operations focused on Gen Z. In December, as Miniso unveiled a Boston store, Andrew Xie, Miniso general manager North America, said the response to those 10 ‘N Under stores “validates our strategy to cater to Gen Z, who place a premium on value: They want trendy, quality products at an affordable price.”

Qurate Retail’s Zulily retail banner has been paying special attention to Gen Z. Zulily recently launched an apparel collection, Sunshine Swing, aimed at the demographic with an emphasis on its younger segment, and even a little younger than that. Kiki Lockwood, Zulily merchandising manager for kid’s apparel, observed, as the collection launched, that Gen Z has contributed “to a fundamental shift in the way families shop today.”

Lockwood told HomePage News

that kids have taken a more hands-on approach to personal style. “Our research shows kids are actively shopping with their parents and customizing outfits to help express themselves in new ways,” she said. “In fact, 99% of parents say their kids influence their purchase decisions, and 90% of kids said it’s important for them to define their unique personal style to set them apart from their peers.

Parents are trying to shop for Gen Z kids who have developed their own sense of style at an early age. In the back-to-school timeframe, Zulily noted that kids are helping steer the shopping cart, particularly the virtual cart online, exerting greater influence over parental purchasing. In Zulily’s 2021 Back-to-School Fashion Forecast, a trend report built from a survey of 1,000 children up to 18 across the United States, the retailer pointed out that self-expression and personal identity are driving factors in Gen Z shopping. It characterized the demographic as emerging in the consumer sense as delineated into one of three general configurations: “Movers & Shakers,” kids who look for styles that help them feel their best; “Glue Guns & Glitter Bombs,” kids determined on customizing their possessions, and “Retro & Reimagined,” kids who look to mom and dad for inspiration.

Sheila Nugent, Zulily director of merchandising for kid’s accessories and DIY, emphasized that the Gen Z desire for personalization doesn’t end with apparel, leading to “significant growth in the DIY category over the past year, which is no surprise since kids want to demonstrate their individuality.”

Renewal

Already, observers perceive a Gen Z appreciation of vintage and repurposed products. Purchasing repurposed goods supports their strong commitment to sustainability and inclination toward value. In a 2021 study by First Insight, 85% of Gen Zers said they shop the secondary or used market, which tied for the highest percentage with Millennials and Gen Xers but represented a bigger gain versus both when compared to 2019 when the response was 59%.

Last year, eBay launched Refurb Registry, a program that encouraged couples to sign up for refurbished products to be purchased by family and friends. The e-tailer developed Refurb Registry to help couples, particularly new couples and first-time householders, adjust to life in what was then thought to be a reopening world post-COVID-19 world. It focused on at-home functions while satisfying a desire many people have to live more sustainably. To establish the program, eBay conducted a survey that determined almost half of married people wished they could redo their wedding registry, with one-third saying they would add more kitchen gadgets and appliances to the list. Refurb Registry offered consumers a means to find premium products that could help them deal with everyday living, such as countertop pressure cookers to simplify dinner preparation or robotic vacuums to automate household cleaning. Therefore, eBay developed a unique selection of certified refurbished products restored by the manufacturer to like-new condition and sold with a two-year warranty with pricing that encouraged Refurb Registry shoppers to consider purchasing aspirational brands.

At a time when supply chain issues raised fears of gift-season scarcity, eBay cited a Wakefield Research survey conclusion that 62% of U.S. consumers had considered buying refurbished electronics, and 84% were open to receiving refurbished gifts in the holiday season. As eBay refurbished debuted, Dawn Block, vice president, hard goods and collectibles at eBay, said, “Amidst strong demand for like-new products, eBay Refurbished is making it even easier for shoppers to access hundreds of thousands of coveted items at substantially lower prices, in one trusted experience.”

Preference for repurposed goods may come out of several considerations when it comes to Gen Zers.

Marsha Everton, principal, corporate director and advisor, The AIMsights Group, a market research organization that specializes in trends with younger consumers, noted that Gen Zers have definite ideas about how they want to shop and how the companies that they engage should behave.

– Marsha Everton, Principal, Corporate Director and Advisor, The AIMsights Group

“Vintage looks are a trend in every consumer category, not just clothing, and it’s about more than sustainability,” Everton said. “ We see a mix of intent to repurpose items that have already been created, great, or at least better, pricing on quality products and finding something ‘unique to me’ rather than the mass-oriented new collection of the season.”

Gen Zers are serious and confident in being their own person and avoiding anything that seems particularly mass market, she said. What’s particularly noteworthy is that Gen Z preferences won’t just be influential across its own demographic. As has been the case of Millennials and their parents, Gen Zers will inform their late Boomer and Gen Xer progenitors about up and coming trends, not just in fashion and technology, but also concerning social perspectives and lifestyles as well.

“It’s not just about a single generation,” Everton said. “It’s more about a mindset that spans across generations, and the Gen Z folks in our lives are teaching us what they know and encouraging us to embrace the mindset as well.”

“Gen Z is very important to understand right now,” Joe Derochowski, vice president and home industry advisor for The NPD Group. “They truly became more home-centric during the pandemic as they ate, entertained and lived more at home compared to pre-pandemic.”

Not only did they follow on a Millennial demographic that itself developed closer-to-home habits while limited by the Great Recession, but Gen Zers have been at least partly confined to home at critical moments in their lives, too. As such, the oldest segment of the demographic, the 18- to 24-year-olds, have missed a period of time when they would have been out and about. Just when they would have become major restaurant consumers, Gen Zers were eating home-cooked and takeout meals in their domiciles. Indeed, they often were involved with the cooking and do-it-yourself projects that occupied their parents. As pandemic-associated restrictions relaxed, they had the chance to socialize with family and friends again. But certain habits and preferences were set. To add another wrinkle to their coming of age, just when they had a chance to circulate, inflation made everything more expensive.

– Joe Derochowski, Vice President and Home Industry Advisor, NPD Group

“This is an important group because it’s the next group hitting major life changes,” Derochowski said. “And it’s going to set the tone on things like sustainability, which is going to be more table stakes when compared to other generations. It’s important to understand, but also recognize the proportion of it. This year, 18- to 24-year-olds account for approximately 7% of housewares dollars and 6% of small appliances.”

Although not a huge part of the population or the current housewares-purchasing base, Gen Z is going to become a lot bigger at an increasing pace. The important role home has played in the lives of Gen Zers and their already recognized fondness for the refurbished products, although currently is playing out more in the electronics space than in the home sector, will have important implications. Sustainability will remain a core issue no matter how it plays out in consumer behavior. Housewares retailers and vendors should call out the measures they’ve taken to ensure products are environmentally friendly. Gen Zers may not be willing to pay a lot more money on average when it comes to sustainability, but things being equal or near to equal, environmental friendliness is likely to be a tie-breaker.

Gen Z looks to be more adventurous in its range of eating behavior, too, Derochowski pointed out.

Social issues are just about as important to Gen Z as the environment, and that will play out as the demographic becomes a bigger economic factor.

Mina Fader, managing director of the Baker Retailing Center at the Wharton School, University of Pennsylvania, noted that authenticity is an issue that’s close in importance to sustainability for Gen Zers.

The importance of sustainability to Gen Z is apparent in a First Insight study conducted with the Baker Retailing Center. Although the elasticity is limited, Gen Z has been consistent in its willingness to spend on the cause of the environment. In 2019, the study indicated, Gen Z led in the category of most willing to spend at least 10% for more sustainable goods, with 54% of participants stating they would versus 54% of Millennials, 34% of Gen Xers and 23% of Millennials despite Gen Z being the group with the least income. In 2021, all demographics expressed a willingness to spend more, and Gen X and Millennials even overtook Gen Z, which came in at 81% versus 88% and 86% respectively, but still ahead of Boomers at 76%.

Fader pointed out that, in another study on the importance of transparency, retailers turned out to be more concerned about having a lack of transparency than consumers at least at this point, which is an indication that it’s an evolving issue. However, she noted that D2C retailers have a jump on the transparency issue as well, with the online brand Everlane, for instance, allowing shoppers to click on a product and find out what facility it was manufactured in, who the workers are, what is the product cost and what is the cost of shipping.

In that study’s conclusion, First Insight maintained that sustainability and other social issues will become more important at retail as Gen Z matures.

Gen Z Financing

Gen Z had a big influence on how purchases are financed during the recent holiday season.

Although kids are an important party of the Gen Z demographic, 18-to 24-year-olds are the ones to watch when tracking the generation’s consumer evolution. They are the ones who had something of a coming-out party as full-fledged consumers during the holiday season, and one of their big demands was for credit.

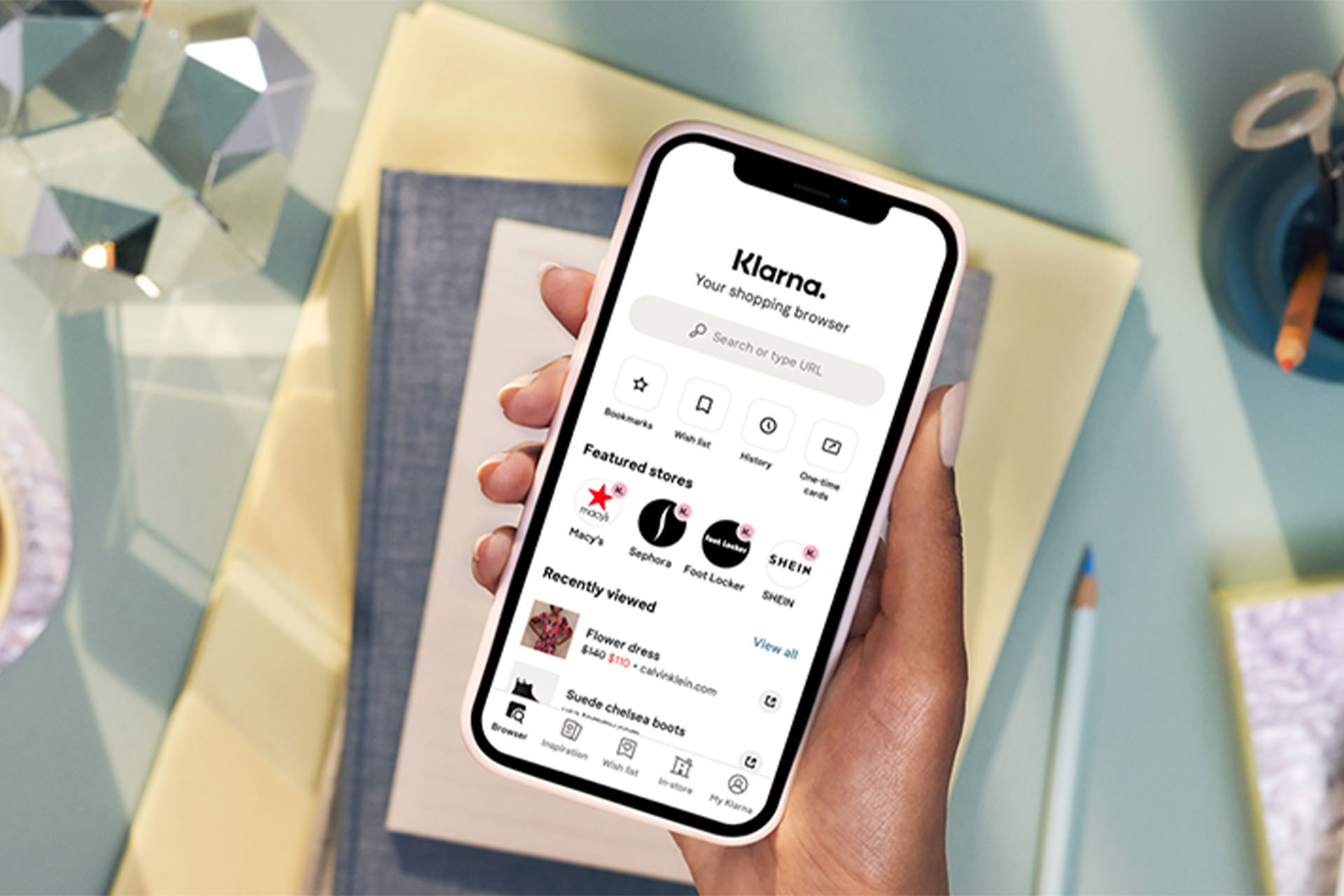

The recent growth of alternative payment methods, following on the rapid expansion of services such as Apple Pay and Paypal and the establishment of buy-now-pay-later (BNPL) specialists including Klarna, Affirm, Allpay and Visa-affiliated Zip, have emerged to provide older Gen Z who can legally use them with a credit option even if they don’t yet qualify for a credit card. Retailers across the mass-market spectrum, including Walmart and Amazon, recently established partnerships with BNLP services, and established alternative payment services, such as Paypal, have their own buy-now-pay-later operations.

Newegg announced in December 2021 it struck a deal with Affirm that gave consumers processing orders of $100 or more the option of paying in monthly installments with the BNLP service. Newegg has had a long relationship with tech-savvy younger consumers who can buy components from its wide assortment and build their own computer equipment. They also can buy standard electronics and a range of other products, including home furnishings and housewares.

Nikki Tanlioco, vice president, of finance at Newegg, told HomePage News that adding the Affirm payment option was an additional benefit expected to be embraced by younger shoppers. The purchasing innovation comes as Newegg has been adding fresh twists to its own e-commerce operations, such as livestream shopping through its app.

Younger people may be early BNLP adopters, given slimmer credit options, but retailers recognize they will help popularize the purchasing option generally.

“We offer both Affirm and Zip as buy now pay later flexible payment options,” said Tanlioco. “We know our Gen Z customers want payment options when making purchase decisions. Other mobile payment types, like PayPal, that differ from credit cards are also popular among this group. However, we also see interest in these payment types beyond just Gen Z. Millennials and others who want to use their preferred payment types. The BNPL payment breaks up the payments over time, giving customers more flexibility to pay in increments when it’s convenient to them.”

BNLP’s popularity has grown rapidly, according to the latest Affirm Consumer Spending Report, as shoppers reevaluate their finances under the influence of the COVID-19 pandemic. Indeed, 61% of respondents to the study that forms the basis of the report believe that living through the pandemic has made younger generations more financially savvy. What’s more, 53% of survey respondents think Millennials and Gen Zers are generally better at managing their finances than Gen Xers and Boomers, at 33%. In the survey, 42% of Gen Zers said they have started saving or plan to start saving by the time they hit 25, versus 28% of Millennials, 24% of Gen Zers and 17% of Baby Boomers who started tucking away cash by the quarter-century mark.

Affirm noted that 51% of Gen Z consumers expressed reluctance to spend without a BNLP option. Although just above the average and trailing Millennials, the Gen Z age range should be considered in the reply. After all, and as is common among BNLP operators, someone applying for Affirm credit has to be 18, or among the oldest Gen Z consumers. The youngest, at around 10, are unlikely to spend a lot of time weighing credit options.

As the retailers expand options, so, too, have alternative payment purveyors. Paypal and Klarna are among those moving aggressively toward becoming more capable shopping support providers and even full-on financial services firms offering debit cards and savings accounts, with Gen Z on the ground floor.

Affirm has taken steps to be a more capable shopping and financial services operator with savings accounts, debit cards and additions to its product suite, including the Affirm SuperApp and Chrome browser extension. The SuperApp delivers shopping, payments and financial services in one easy-to-use destination, Affirm asserted, while Google Chrome browser extension allows consumers access to Affirm payment solutions at almost any retailer website, even if it isn’t listed as available at checkout.

A Klarna spokesperson said Gen Z’s use of BNPL increased 88% in the 2021 holiday season, although older consumers were more likely to try out the alternative payment method over the timeframe as well. Gen Z may not have been the largest demographic to purchase via BNLP, but the interest expressed seems likely to translate into significantly more spending.

Klarna’s research identifies areas where Gen Z is adopting different spending patterns than other generations.

“Gen Z consumers have done their research, mostly on social media, according to Klarna’s data, and know what they want,” the spokesperson noted, “78% say they have purchased a product after seeing it on social platforms.”

Klarna is adapting to Gen Z priorities, offering customers various benefits “that go beyond flexible, interest-free payments, including the ability to activate price drop notifications and find exclusive deals from our retail partners. They can also track packages from store to door and manage payments all in one place. Since launching our rewards club Vibe in September 2020, more than 2.1 million have joined, ensuring they enjoy more value for every dollar they spend. Members earn one Vibe for every $1 spent with Klarna. Then, they can turn those Vibes into rewards they can redeem with world-class brands like Amazon, Walmart, Starbucks, Target, Finish Line, H&M, Sephora, and many more,” the spokesperson said.