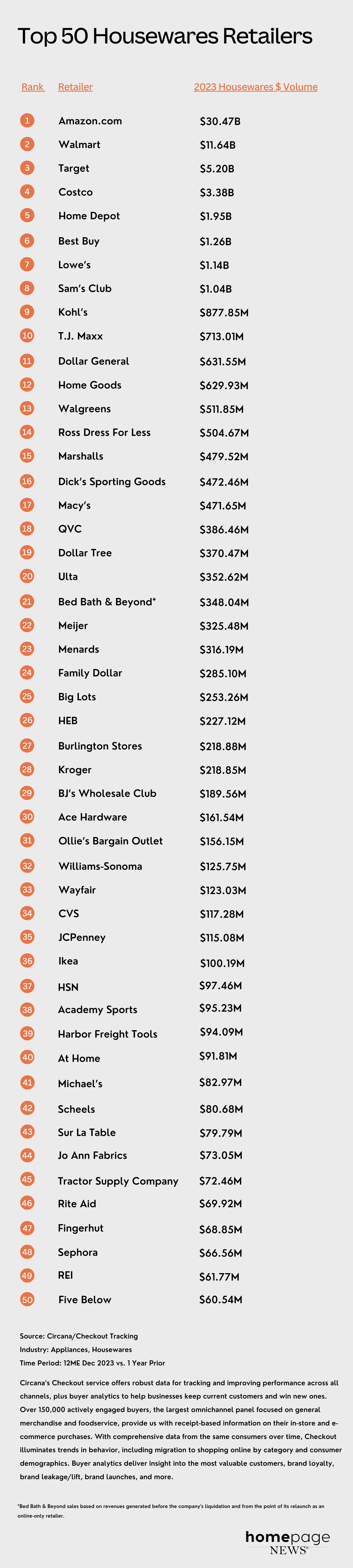

The HomePage News Top 50 Housewares Retailers report demonstrates that while the biggest retailers command the majority of housewares sales, the variety of companies that generate significant revenues in the sector is noteworthy.

What seems clear is that no overwhelming trend has emerged to suggest a definitive housewares retailing future. Yet, that very situation suggests opportunity exists for those retailers that can focus on the consumer and use emerging capabilities and technologies to address their most pressing needs.

The top housewares retailers have in common their positioning as omnichannel operators. They are the most deeply invested in e-commerce and the unification of digital with brick-and-mortar stores. Still, even retailers that downplay or even forego e-commerce — for example, TJX Cos. in the case of its HomeGoods banner being perhaps the most notable — are, in many situations, major housewares sellers. The status of supermarket operators such as HEB and Kroger and drug chains Walgreens, CVS and Rite Aid among the Top 50 Housewares Retailers provides evidence consumers continue to purchase a significant volume of housewares on impulse or simply in the course of their regular activities. Of course, Kroger operates some formats that are much more general merchandise oriented than the average supermarket, yet the supermarkets and even dollar stores have endured and, in some cases, advanced as housewares retailers, which itself is an indication consumers still shop the sector across a wide range of circumstances.

Even if observers at times emphasize the present ability of consumers to carefully and conveniently research their purchases online, shoppers who understand and trust a retailer’s brand positioning might purchase on that basis without recourse to the Internet.

How consumers shop today is subject to volumes of market research and sales analysis. Yet, the marketplace and larger economy today still are in a state of transition that is peculiar to recent market disruptions. The COVID-19 pandemic impact on retail isn’t over. In the larger economy, the follow-on effects continue to shake up markets already reshaped by the pandemic.

The pandemic effects are fundamental for a critical underlying reason.

“What COVID has done is it has changed how consumers shop across the board,” said Joe Derochowski, home industry advisor at market research firm Circana.

Walgreens, No. 13

Now, even with the changes consumers have faced in their personal lives because of the pandemic and its aftermath, they are seeing another wave of change given recent innovations, including the application of artificial intelligence, new store formats, and drone delivery. At the same time, other forces are having their effects. This includes the emergence of GenZ consumers, who don’t seem to quite align with Millennials in terms of habits and preferences; and a profound shift in the labor market from abundant availability to scarcity that was influenced by COVID.

To make the most of a changing environment, retailers and their suppliers have the ability to react and innovate effectively if they keep the evolving consumer clearly at the center of their initiatives. Technology can be an effective means to an end, but it shouldn’t become a distraction. Companies are likely to see the most success by using technology to gauge and address changing consumer preferences when it comes to products, engagement and their navigation through the shopping trip from conception to checkout.

For his part, Circana’s Derochowski observes, “There are transformation windows over time, and we’re in one of those right now as relates to the path to purchase. One of the big innovations is in how we shop. It is ripe for disruption.”

The pandemic forced consumers to change their shopping habits. Although some people have long held that online was going to largely, if not totally, replace the shopping trip, even the pandemic couldn’t sever the connection between consumers and stores. E-commerce has certainly gained but in a mixed marketplace. Even retail channels that remain primarily focused on physical store operations can continue to gain ground, as the Top 50 Housewares Retailer rankings demonstrate.

That being said, consumers responded to the innovation that omnichannel retailing has introduced. Digital capabilities have changed how consumers research, shop, buy, and return products. It’s no wonder that retailers are adapting technologies, such as AI-enhanced search, for instance, so they can be used more easily in stores.

The market continues evolving, lately as social media and influencer marketing and retail media networks have drawn more attention. Although still in the early days, such developments are likely to have ramifications that have yet to become clear. As they assess the potential of such technologies, major retailers have applied resources to launching new engagement initiatives, sometimes building them and sometimes abandoning them or deemphasizing them as they figure out how they can apply such innovations effectively. Smaller retailers, which often have more operational flexibility, might be able to apply innovations faster and more effectively. With all that’s occurring, the future looks exceptionally hazy at this point in the evolution of housewares retailing. Yet, it is at least possible to see which companies are making headway.

Evaluating The Present Situation

As the HomePage News Top 50 Housewares Retailers ranking for 2023 reveals, Amazon and Walmart represent the bulk of the housewares retail market, and Amazon alone is in a dominant position.

Rankings at the top changed little year over year, with Amazon, Walmart, Target, Costco and Home Depot leading. In the number six to 10 rankings, Best Buy advanced one position to sixth place, the spot occupied by Bed Bath & Beyond in the previous 2022 ranking. Lowe’s jumped up three slots to seventh place, Sam’s Club remained at eight and Kohl’s held on at nine, with the company’s in-store Sephora shops likely helping the company to stick, as well as its move to revitalize the home business. Sephora has been gaining to the extent that, as a separate enterprise, it slipped into the Top 50 this year, taking 48th place.

T.J. Maxx broke into the Top 10 in 2023 from its previous 11 ranking. At the same time, HomeGoods moved from 14th to 12th position year over year on the Top 50 list, while Marshalls retained its number 15 slot. If you put their sales together, TJX would come in at number six overall, despite a limited interest in e-commerce.

T.J. Maxx, No. 10

Dollar General made a big move on the list, up to 11 from 16 last year. As noted, HomeGoods jumped two places to 12, and Walgreens jumped from 17 to 13. Ross slipped a bit, down to 14 from 12 previously. Marshalls stood pat at 15, and Dicks Sporting Goods moved from 21 to 16. Macy’s fell from 13 to 17, and QVC moved up a spot from 19 to 18, as Dollar Tree kicked it up from 22 to 19. Ulta slid to 18 to 20.

Bed Bath and Beyond fell from the top 10 after a tumultuous year that included its liquidation, the purchase of its intellectual property by Overstock and its reemergence as an online-only retailer. With sales across the year taken into account, including before its bankruptcy liquidation and from the point of its digital revival, Bed Bath & Beyond ranked at 21st in the Top 50 for 2023.

In the trailing banners, shifts were one or two positions for the most part, but Burlington Stores moved up from 30 to 27 in 2023, a year in which it purchased the leases for 62 former Bed Bath & Beyond locations. A solid home goods program was also key to Burlington’s gains.

Wayfair made a significant gain, up from 44 to 33 as it made housewares a more prominent part of the operation while battling the slump in the furniture market.

Wayfair, No. 33

At Home slipped from 37th to 40th position after shifting to private ownership in 2021 and making major management moves thereafter, including bringing in former Walmart executive Jeff Evans as president and chief merchandising officer during May. Scheels, specializing in sporting goods but offering a broad range of peripheral products in stores operating from Arizona to Wisconsin, made it onto this year’s Top 50, arriving at 42. In a similar vein, Tractor Supply entered the Top 50 list this year at 45 after a two-year absence. As mentioned, Sephora also jumped onto the list, securing the 48th position, while outdoor and sporting goods supplier REI slipped into the 49th spot.

Although the company had its financial trials this year, JoAnn did well in housewares during 2023, enough so to boost its ranking from 50 to 44, while Academy Sports made an even bigger advance from 46 to 38.

Fingerhut took a tumble from 40 to 47, while Five Below slipped from 45 to 50. Belk, Crate & Barrel and Woot all failed to make this year’s Top 50 Housewares Retailer ranking.

Change in the Top 50 can still be traced back to the pandemic and its effect on the market, even if, at a time of generational and economic change, with labor shortages being a prime example, COVID’s effect on retail has to be qualified. That being said, the driving forces that molded the shape of the new Top 50 will remain in effect, at least for the immediate future. If that’s the case, consumers will exercise the shopping options that emerge in a variety of ways that suit each individual. Some will put on goggles and shop in virtual reality and others will tear through the racks on an off-price sales floor.

Search for Tomorrow

Housewares retailing as it exists today has undergone a rapid transformation. The pandemic increased the importance of certain retail operations that existed before, at least in limited form, such as buying online pick up in-store. In the marketplace, as it existed in 2023, consumers had more purchase options available, some of which they had tapped into during the COVID-19 pandemic. In that way, the pandemic disturbed consumer shopping habits but also spurred a willingness to try new ways of approaching retail.

Indeed, in some ways, it compelled them to do so, first for fear of getting sick, then to find scarce goods and deal with inflation that pressured budgets. At the same time, social media took its own path and went from being a place to share and compare purchases to a buying platform and a source of “retailtainment,” with influencers assuming much the same role as video commerce hosts. Payment changed, too, with buy-now-pay-later options and platforms such as Venmo becoming available.

Although a lot of innovation has been launched in e-commerce, retailers have been integrating those concepts and functions into in-store shopping more aggressively as unified commerce has become an attractive model. Retailers recognized that they need to offer shoppers in physical stores the same kind of amenities and benefits they have come to expect online.

Amazon, in a bit of irony, has been a leader in bringing ease of checkout to physical stores through its Just Walk Out and related technologies. Yet, even while they consider innovation in the cause of better shopping experiences, retailers operating physical stores are updating their approaches to communication with shoppers through retail media networks that have the potential to deliver not only traditional advertising but everything from review-based product recommendations generated by AI to influencer programming.

“There is a need for both channels, but what we need to think about is what is the path of purchase,” Circana’s Derochowski said. From his perspective, Derochowski sees opportunity in a focus on consumers as they evolve in a compelling retail environment and a commitment to providing products that fire their enthusiasm.

“The consumer is looking to be inspired,” Derochowski said.

Consumers already use their devices as shopping aids by researching prices and reviews on items they’re thinking about purchasing in-store. Retailers are working to make smartphones and similar devices even more effective as in-store helpers, particularly through apps, creating additional functionalities consumers can apply on the sales floor, including those that can use a snapshot to view how a product will fit in a room set to identify where a particular product is in the store. With AI entering the picture, virtual shopping assistants have rolled out and voice-operated helpers, such as Amazon’s AI-invested recently deployed Rufus, are just a start on what will come.

At the same time, a new wave of retail is coming in from Asia with a value proposition meant to win over younger shoppers and operations that not only employ social media but also conduct themselves similarly by facilitating communications and community building among customers. Alongside the new entrants, recommerce is gaining among consumers who not only see the price and sustainability advantages but also have a greater concern with long-term product value. The Asian retailers tend to feature low-priced, effectively disposable goods, often in a fast-fashion approach, while the retailers driving recommerce are counting on consumers embracing merchandise designed to last as they promote a circular economy. Yet, using the flexibility that the Internet provides, companies such as Shein that have taken a fast-fashion approach are now creating their own resale operations. In doing so, they might have found an answer to at least part of the returns challenge, in that shoppers might be less likely to purchase, use and immediately return goods if they can get a little more play out of a product and something back for it later.

What’s likely to be the most substantial development in retail’s future is the unified commerce melding of online and in-store operations. This is an effort that will make retailers more compatible while extend similar benefits so consumers can complete their shopping activities easily and in a more satisfying manner.

“There is a need for both channels, but what we need to think about is what is the path of purchase,” Circana’s Derochowski said. From his perspective, Derochowski sees opportunity in a focus on consumers as they evolve in a compelling retail environment and a commitment to providing products that fire their enthusiasm.

“The consumer is looking to be inspired,” Derochowski said.

The Top 50 Housewares Retailers, developed for HomePage News by Circana, ranks retailers by total 2023 sales in the following categories: small kitchen appliances; personal care appliances; home comfort appliances; floorcare appliances; water filtration devices; cookware; bakeware; cutlery; gadgets and tools for prepping, cooking, serving and entertaining; kettles; food storage; portable beverageware; cleaning tools and accessories; kitchen organization; and tabletop.